Green Tax Incentives

Renewable Energy Tax Incentives Guide

Federal Tax Credits for Renewable Energy

The Federal Government of the United States offers several tax incentives to promote the adoption of renewable energy systems. These incentives are designed to make green energy solutions more affordable for homeowners and to encourage the shift away from fossil fuels.

Investment Tax Credit (ITC):

- The ITC, also known as the federal solar tax credit, allows homeowners to deduct 26% of the cost of installing a solar energy system from their federal taxes for systems installed in 2020-2022. This rate drops to 22% for systems installed in 2023 and is currently set to expire at the end of 2023 unless extended.

- Applies to both residential and commercial properties, and there is no cap on its value.

Residential Energy Efficient Property Credit:

- This tax credit applies to energy-efficient improvements in the home, including solar panels, solar-powered water heaters, wind turbines, geothermal heat pumps, and fuel cells.

- For most technologies, the credit covers 30% of the cost, including installation with no upper limit through 2019, then phased down to 26% in 2020-2022, and 22% in 2023.

It's important for homeowners to consult with a tax professional to understand how these credits can be applied in their specific situation.

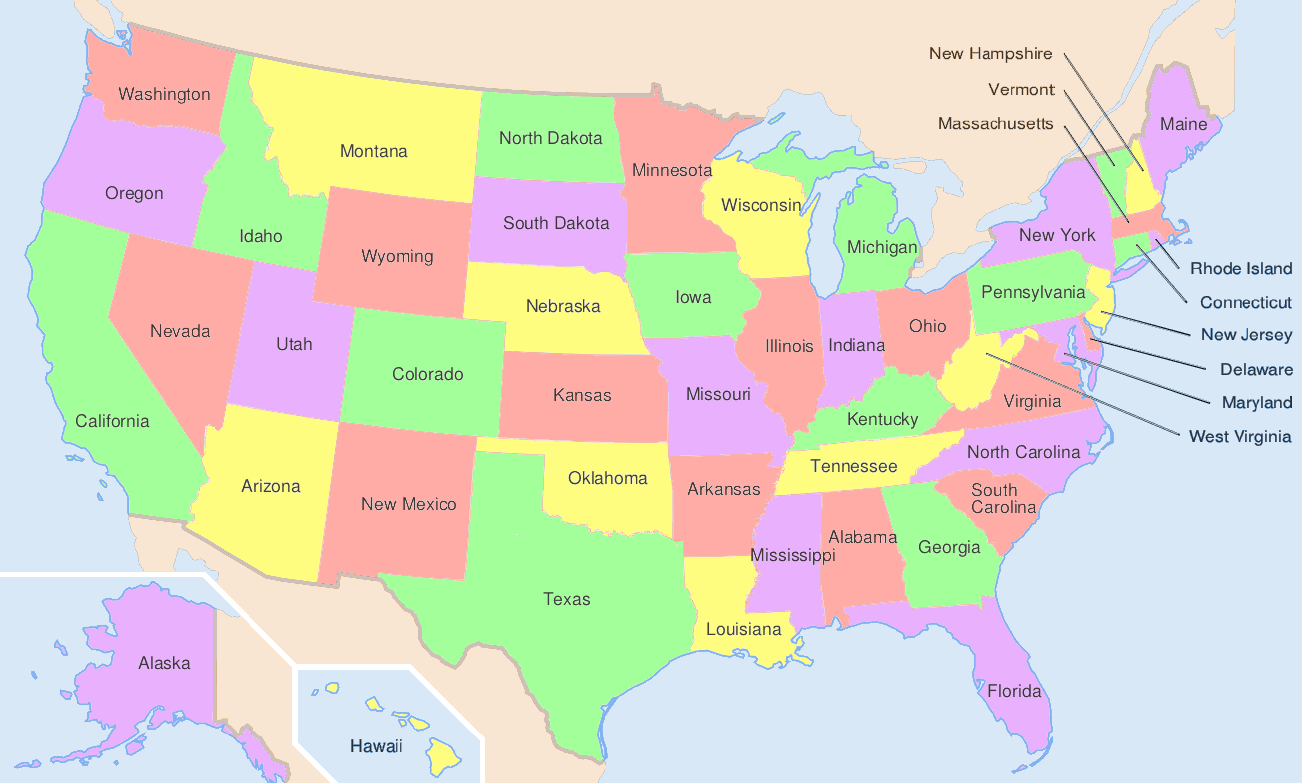

State-Specific Incentives and Rebates

In addition to federal incentives, individual states offer a variety of rebates and incentives to promote renewable energy and energy-efficient practices. These incentives can significantly reduce the net cost of installing renewable energy systems and improve the return on investment for homeowners.

Examples of State-Specific Programs:

- Georgia: In Georgia, utility companies like Georgia Power offer rebates for residential and commercial solar installations. These incentives help reduce the initial cost of solar panel installation, promoting the adoption of renewable energy in the state.

- California: In California, the California Solar Initiative (CSI) provides cash back for installing solar on your home or business. Additionally, the Self-Generation Incentive Program (SGIP) offers incentives for installing energy storage systems.

- New York: The NY-Sun Initiative provides financial incentives for installing solar panels. The program’s Megawatt Block structure offers higher incentives for early adopters and decreases the incentive level over time as more solar is installed in the state.

- Texas: While Texas doesn't have a state-wide solar tax credit or rebate program, many utilities and local governments offer incentives. For example, the Austin Energy Utility offers a rebate for customers who install solar panels.

Homeowners should check with their state energy office or local utility company for specific details, as these programs are subject to change and vary greatly by location.